Home » Restaurant Budget Accountability: How to Set Realistic Goals and Incentives

Running a restaurant is tough. Rising labor costs, unpredictable sales, and slim margins make financial discipline essential. Yet many operators fall into a common trap: setting ambitious stretch goals instead of building realistic budgets their teams can actually follow.

Restaurant budget accountability addresses this problem directly. The goal isn’t simply to slash costs. It’s about giving every manager and team member clear targets, ownership of results, and tools to make better financial decisions every day.

Stretch targets may sound inspiring, but realistic budgets are what keep operations on track. When restaurant leaders confuse the two, accountability breaks down.

Imagine telling managers to hit a 25% labor cost in a market where wages push the realistic number closer to 30%. Everyone knows the goal is impossible. Morale sinks, bonuses go unpaid, and managers stop paying close attention to schedules and waste.

Unrealistic goals create disengagement, while realistic, data-backed budgets give teams confidence. When incentives align with achievable targets, such as reducing prime cost by one point compared to last quarter, managers are motivated to act.

To avoid this disconnect, operators can use tools like restaurant forecasting, which applies real sales data to set benchmarks that teams can actually reach.

Restaurant budget accountability means:

A kitchen manager might own food costs, while the GM owns labor scheduling. When each leader knows what they control, accountability becomes a shared effort instead of a directive from above.

Building accountability also depends on accurate restaurant accounting practices. With clear reporting, managers can see where labor cost percentage or food cost percentage drifts from the plan and take corrective action quickly.

Even well-meaning plans fall apart without accountability. The most common pitfalls usually fall into three areas.

Many of these issues mirror the top restaurant accounting mistakes, like relying on poor data or failing to update budgets when conditions change. When accountability fades, goals are missed, resources are wasted, and cash flow problems pile up.

Accountability works when it’s part of the culture, not just a line in the budget spreadsheet. Restaurants that succeed usually build on three foundations.

They start by engaging the team early, involving managers when setting targets so responsibility is shared rather than imposed. They also foster open communication, holding regular budget meetings to review results, surface challenges, and adjust as a group. And they align incentives with reality, rewarding progress on achievable, data-driven goals. A one-point improvement in prime cost is far more motivating than an impossible labor target.

Operators that embed accountability into planning often use structured methods such as the FTE model, which helps control costs and align staffing decisions with financial targets.

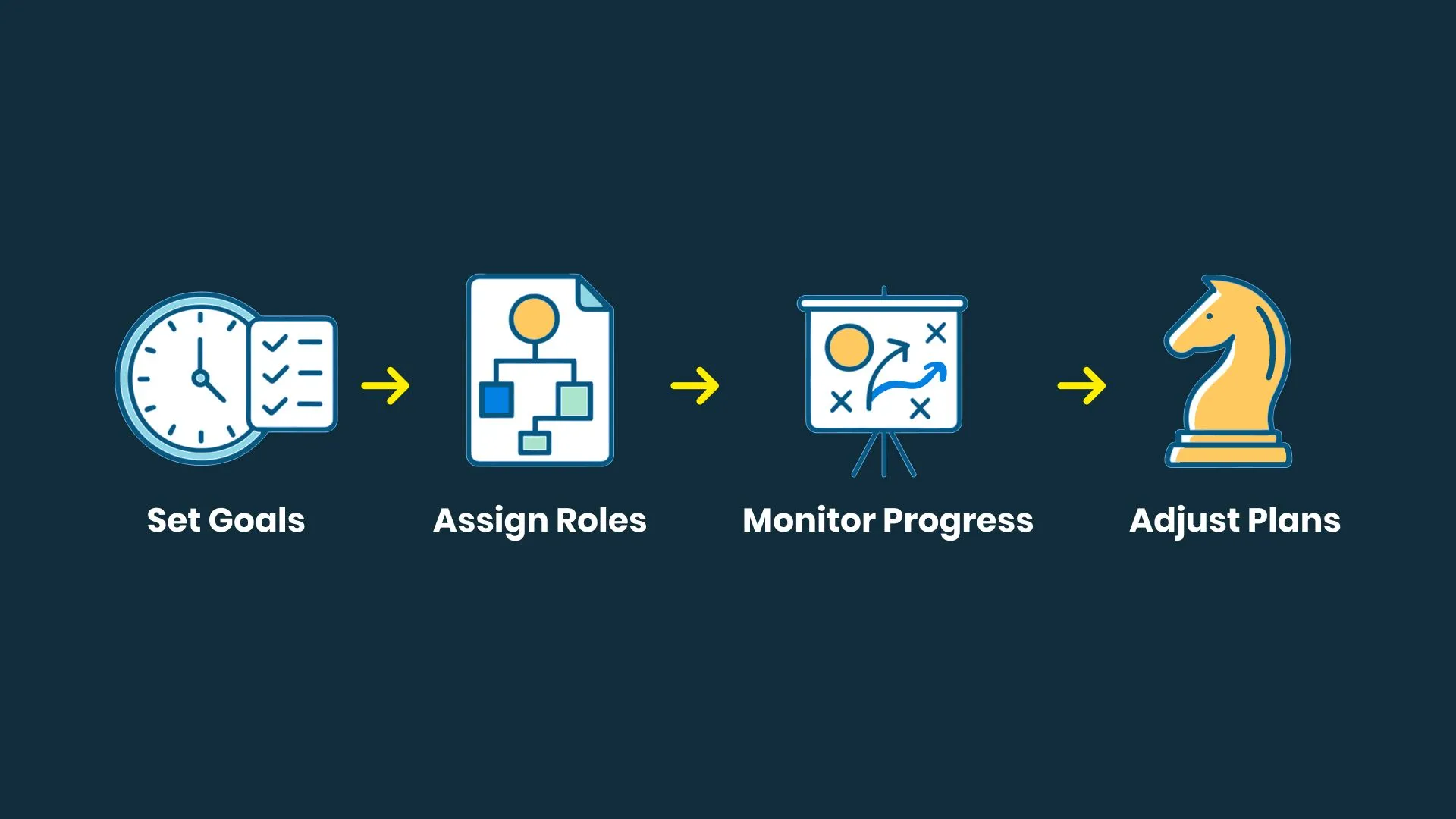

A straightforward way to bring restaurant budget accountability into your business is to follow four steps.

Start by setting data-driven goals, using the past 12 months of results to define realistic targets for sales, labor, and food costs. Next, assign ownership by giving each manager responsibility for specific line items, such as food cost percentage or labor scheduling. Then, monitor results with weekly or bi-weekly check-ins, and agree on corrective actions as soon as variances appear. Finally, adjust and improve by celebrating wins, documenting lessons, and refining targets each cycle.

Budget accountability is easier with the right resources. Many operators rely on restaurant accounting services and financial templates to standardize processes and ensure managers always know their numbers.

Modern tools simplify accountability:

To evaluate the best fit for your business, explore the top restaurant accounting software solutions and compare features for forecasting, reporting, and cost control.

Restaurants that commit to accountability see clearer financial visibility, stronger margins, and steadier cash flow. Instead of constantly reacting to crises, operators can focus on growth.

With food and labor costs rising, accountability has shifted from a nice-to-have to a real advantage. By setting realistic goals, assigning ownership, and aligning incentives with reality, you can use your budget as a daily management tool instead of letting it sit untouched in a spreadsheet.

If you’re looking to strengthen margins and free up time for growth, GSS can help. Our restaurant accounting services give you the structure and insights to keep your team accountable and your finances on track. Restaurant budget accountability helps operators move past stretch goals and focus on long-term profitability.

Restaurant budget accountability helps restaurant owners align their financial goals with day-to-day business operations. By assigning ownership over food costs, labor expenses, and other variable costs, operators can significantly streamline financial management. This accountability not only improves the restaurant’s financial health but also sets the foundation for long-term success and growth.

Historical sales data allows restaurant managers to project future sales, set accurate budget targets, and predict future revenue fluctuations. It helps identify patterns in food and beverage costs, sales volume, and seasonality—making the budgeting process more data-driven and reliable. This ensures a restaurant’s budget breakdown is rooted in reality, not guesswork.

In a competitive industry, successful restaurants plan ahead for external factors like property taxes, equipment failures, or payroll taxes. Using accounting software and real-time reporting, restaurant owners can manage costs dynamically and make informed financial decisions that protect cash flow and maintain profitability—even when actual costs differ from projected sales.

Effective financial management requires detailed tracking of food and beverage costs through inventory management, waste reduction, and optimized pricing strategies. By closely monitoring cost of goods sold (COGS) and prime costs, restaurant managers can reduce food waste and adjust menu prices to protect the restaurant’s profitability.

Labor costs are one of the largest components of operating expenses, often including wages, benefits, and payroll taxes. A clear restaurant budget assigns ownership of scheduling and staffing decisions, helping managers control labor expenses as part of total restaurant costs. When labor is aligned with projected sales, it becomes easier to hit budget targets and improve financial performance.

Absolutely. Sales forecasting uses sales data, customer trends, and marketing costs to project future sales. This gives restaurant owners the insight they need to adjust operating costs, reduce semi-variable costs, and align marketing budgets with expected demand—ultimately helping restaurants manage cash flow more effectively.

Many restaurants rely on restaurant accounting platforms that combine POS, accounts payable, and payroll tools into one system. These solutions offer real-time visibility into restaurant sales, fixed costs, and recurring expenses—helping teams manage costs proactively and stay on track with financial goals throughout the year.

A dedicated restaurant accountant brings specialized knowledge of the restaurant industry, from cost of food tracking to optimizing operating expenses. They help manage the accounting process efficiently, ensuring that actual costs match up with your budget plan. This partnership enables better decisions, protects restaurant profit margins, and contributes to long-term financial stability.